Updates and Amendments 28 15. A tax deduction reduces the amount of your.

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Rental Income Deductible Expenses.

. Rental income is taxed at a flat rate of 26. Examples of initial expenses are-. Special relief for domestic travelling expenses until YA 2021.

Accommodation fees on a tourist accommodation premises registered with the Ministry of Tourism Arts and Culture Malaysia. I own the property but I dont receive the rent. 4 Rental income earned by nonresident individuals is taxed at a flat rate of 25.

Malaysia Income Tax Deduction YA 2020 Explained. Technical fee rental of movable property payment to a non-resident public entertainer or other payments made to non-residents. However those rental income are taxable based on Malaysia Taxation Law.

Must be evidenced by a registered medical practitioner or written certification of a qualified carer. However there are specific deductions allowed such as incorporation expenses and recruitment expenses conditions apply. The key issue that one should pay attention when claiming a tax deduction is whether the expenditure is wholly and exclusively incurred in the production.

This special deduction will be granted under Income Tax Rules. Replacement Cost of Furnishings 28 13. Medical treatment special needs and carer expenses for parents.

Yes taxable under 2020 income Year of Assessment 2021 Rental income is taxable from the date it is due and payable to the property owner NOT the date of actual receipt of payment. Income-generating expenses such as quit rent assessment repairs and maintenance fire insurance service charge sinking fund and management fees are deductible. Stay in Malaysia less than 182 days are taxed at flat rate of 28 without.

A company is tax resident in Malaysia for a basis year if. 2 Exchange rate used. This special deduction is for a period of rental reduction offered from April 2020 until September 2020.

For instance they include. Income-generating expenses are deductible from the gross rent such as interest expense cost of repairs assessment tax quit rent and agents commission. It can be derived from immovable properties and movable properties.

Letting of Part of Building Used in the Business 28 14. A company is tax resident in Malaysia for a basis year if. Non-passive income means you can use any losses to offset other types of income and you wont be subject to the 38 tax that applies to net investment income.

Includes care and treatment by a nursing home and non-cosmetic dental treatment. Under the Economic Stimulus Package 30 the government is pushing for citizens to do good unto one another and offering this incentive in exchange. Income from the letting of real property in Malaysia is named as rental income and is chargeable to tax under section 4 d of the.

B Legal cost and stamp duty for initial tenancy agreement. Technical fee rental of movable property payment to a non-resident public entertainer or other payments made to non-residents. Yes youre still taxed as youre the owner.

Legislated to allow certain specific expenses an income deduction notwithstanding such expenses do not satisfy the allowable business expenses criteria. A Advertising cost to secure the first tenant. Here is a list of the other things you can deduct according to the Canada Revenue Agency.

From April 2020 to 31 December 2021 landlords of business premises that offer reduction or relief on rent to SME tenants can claim a special deduction. If youre renting a property out commercially good news. There are many things to learn to become an expert this is why we have accountants but the essentials actually are.

Depreciation does not qualify for tax deductions. Example of deduction calculation. How is this special deduction granted.

Bhd rents a shop lot to B which is an eligible SME for RM5000 a month RM60000 yearly. Additional deduction of MYR 1000 for YA 2021 increased maximum to MYR 3000. Malaysia Rental Income Tax Deductible Expenses Us Expat Taxes Explained Rental Property In The Us - An official website of the united states government ita home this interview will help you determine if.

C Real estate agent commission to secure the. This allows your rental property involvement to receive non-passive tax treatment. Interest expense is allowed as a deduction if the expense was incurred on any money borrowed and employed in the production of gross income or laid out on assets used or held for the production of gross.

But to benefit from this approach you need to be meticulous about bookkeeping and accounting. Advertising that tries to attract people to your rental property. Rental Income Received in Advance 18 10.

Capital Allowance 25 11. Nonresidents are taxed at a flat rate of 26 on their Malaysian-sourced income. Non-deductible expenses are initial expense because it is incurred to create a source of rental income and not incurred in the production of rental income.

Entrance fees to tourist attractions. Expense Relating to Income of Letting of Real Property 13 9. Rent was due in Dec 2020 tenant only pays in Jan 2021.

The legislation dealing with the general deduction is stated in Section 33 1 of the ITA. Hence it is important for property investors to understand the actual taxation on rental income before they start to rent their property out. The expenses that are income tax deductible including.

Your insurance on the property. Tax is governed strictly by tax laws which in Malaysia is principally the Income Tax Act 1967 ITA. Before declaring your rental income to LHDN you should start from the rental income sources.

Several different fees from lawyers and mortgage brokers. Legislated to allow certain specific expenses an income deduction notwithstanding such expenses do not satisfy the allowable business expenses criteria. 100 US 400 MYR.

The cost of office supplies obviously this applies more to large-scale landlords. Industrial Building Allowance 28 12.

How To Declare Your Rental Income For Lhdn 2021 Speedhome Guide

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

Renting My House While Living Abroad Us And Expat Taxes

Avoiding Rental Pitfalls The Star

Provision For Income Tax Definition Formula Calculation Examples

Get 50 Tax Deduction From Property Rental Income Rentguard

Overview Of Slovak Real Estate Tax Rsm Consulting Sk

How To Keep Track Of Rental Property Expenses Rental Property Investment Real Estate Investing Rental Property Rental Property Management

How To Account For Incidental Revenues And Expenses During Construction Smythe Llp Chartered Professional Accountants

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

8 Things To Know When Declaring Rental Income To Lhdn

Global Rental Income Tax Comparison

Special Tax Deduction On Rental Reduction

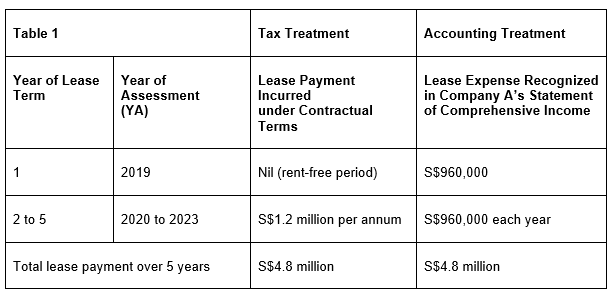

Tax Treatment For Rental Of Business Premises Crowe Singapore

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Landlord 101 What Are The Costs Involved Part Ii Instahome